Gold / Oil ratio refers to how much crude oil can be bought with one ounce of Gold. With gold at $1000 per ounce and oil at $66 per barrel, the Gold/Oil ratio is at 15.15. The average for the last 40 years has been around 15.

The gold-oil ratio identifies:

– Buying opportunities (for gold) when the gold-oil ratio turns up at/below 10 barrels/ounce; and

– Selling opportunities when the gold-oil ratio turns down at/above 20 barrels/ounce.

– Selling opportunities when the gold-oil ratio turns down at/above 20 barrels/ounce.

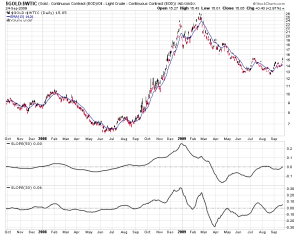

Gold-Oil ratio had peaked to 26 during mid of Februray 2009 which shows that either Gold is overbought or Oil is oversold heavily. Since then Gold has almost remains constant with a 5-10% fluctuation with Crude increasing from $35/Barrel to 75$/Barrel which leads the Gold-Crude oil ratio to 12 during mid of August 2009

From the charts you could see that recently Gold-Oil ratio is increasing once again Since of August from 12 to 15 along with

positive divergence as seen in slope indicator. Slope Indicator 20 and 50 day period turning Positive indicates that the uptrend in

gold crude oil is likely to continue.

So what does a rising Gold-Crude oil ratio means?

1)Either Gold should remain constant with minor flucutations and crude should move down heavily

2)Gold Should move higher with Crude should remain constant

Any one of the above two factors will make the Gold-Crude oil ratio to inch up higher

Related readings

Gold-Oil ratio Lookup – 19 Jan 2009