The context had nothing much changed from the last write up , except the market moved from a 100 point range to 200 point range.Volatility is much improved for this week. Nifty Futures attempted a fresh all time high and closed higher with euphoric global market optimism. Higher timeframe shows more of a weaker momentum buying and weaker hand buyers are getting baited at 10500 psychological levels and Previous Swing High reference 10530 which most of the short term players tend to watch that reference.

Nifty Futures Trading Sentiment

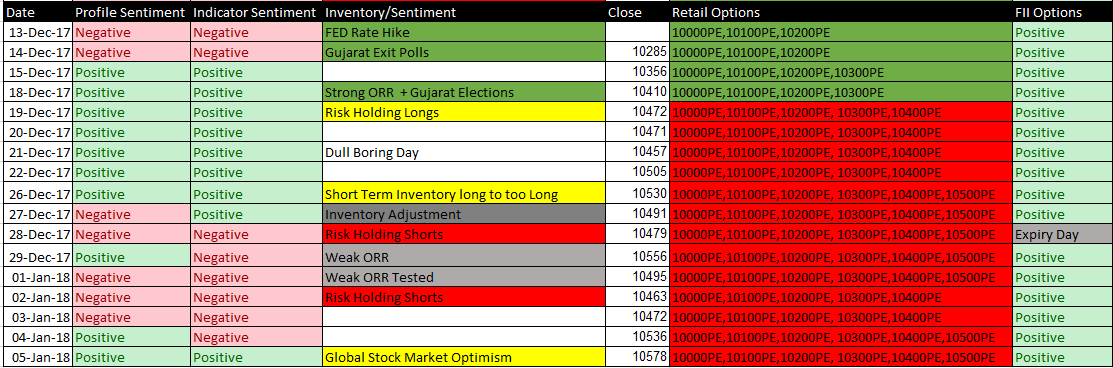

Indicator Sentiment turned positive. Put writers are still over aggressive at 10000PE, 10100PE, 10200PE, 10300PE, 10400PE & 10500PE which is a worrying concern for a sustained uptrend. Too much of put writing indicates highly overconfidence trading environment possibly dominated by laggard buyers.

Nifty Futures – Market Profile Sentiment

From the Market Profile Charts weaker momentum buyers are witnessed in the last couple of trading sessions with slow and compressed one-timeframing in the second half of session on Thursday and Wednesday indicating a possible weaker momentum players are dominating this market in the last two trading sessions.

Key Reference Level

1)Jan 2018 All time High and Poor High – 10600

3)Prev Week Low – 10436

5)Weaker Reference – 10112

6)P Shape Reference – 10423 (Gujarat Election Results Reference)

7)Strong ORR reference – 10373

When the Global Market Optimism is running there, those are times tough to be on the contrarian side of thinking. If there is any meaningful continuation on downside then possibly 10373 – 10423 is the next reference in Jan series to look for any possible support. Price acceptance below 10373 – 10423 band and holding below can drag nifty futures towards 10000 or even lower levels.