How an investor can measure the risk

Will an investor choose a mutual fund based on returns only? Absolutely a big NO. So portfolio’s performance should be associated with volatility,a major factor resulting in risk-adjusted returns. Sharpe and Sortino ratios are the metrics used as performance measurement ratios.

What is Sharpe ratio

Sharpe ratio measures the excess return per unit of deviation in an investment asset or trading strategy.Sharpe ratio is developed by Nobel laureate William F. Sharpe. Sharpe ratio is calculated as follows

Sharpe ratio = (Mean portfolio return – Risk- freerate)/Standard deviation of portfolio return

How sharpe ratio is used

1.Sharpe ratio is used in comparing the change in portfolio’s overall risk returns taking into account a new asset or asset class

2.Sharpe ratio tells whether the returns are from good decisions or out of high risk

Pitfalls of Sharpe Ratio

1.Sharpe ratio application is limited for the portfolio’s that have normal distribution of expected returns

2.For portfolio’s holding options or warrants ,sharpe ratio failed to do analysis with this kind of non linear risks

Corrective measures for Sharpe ratio

1.Measurement level can be increased

2.Standard deviation is calculated from not compounded monthly returns

3.By writing out-of-the-money puts and calls on a portfolio

4.Using pricing models that understate monthly returns

5.Extreme returns are eliminated to reduce the standard deviation

But one more ratio helps in analyzing the risk performance i.e Sortino ratio

What is Sortino Ratio

The Sortino ratio, named after Frank A. Sortino, measures the risk-adjusted return of an individual asset or a portfolio. Unlike sharpe ratio,volatility is calculated by taking the standard deviation of the negative returns. A high sortino ratio tells there is a low probability of a large loss.Sortino ratio can be calculated as follows:

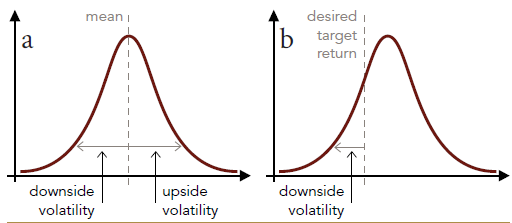

Standard deviation of the returns shows the daily returns from the average period.standard deviation and the returns are directly proportional.In sortino ratio downside standard deviation gives only the volatility of negative returns

Why sortino ratio is preferred

Generally investors neglect the positive volatility ,concentrate on the volatility or the risk of negative returns. If one measures risk over large periods ,the sortino ratio is not effective in this scenario as volatility of returns is low due to insufficient data. And on the other side sortino ratio is effective in comparing high volatile portfolios over shorter periods of time. Higher the ratio ,it is better

Sharpe ratio vs Sortino ratio

Shortcomings of sharpe ratio is overcome by sortino ratio as former relies on standard deviation and uses mean return whereas latter lies on downside volatility. Generally speaking some methods taking all periodic returns and if any returns exceed the minimum accepted value is considered to be zero and finally standard deviation is calculated. But as some returns considering as zero underestimates the volatility. One of the option is to ignore positive volatility itself and taking into account only the standard deviation of negative returns. As sortino ratio is measuring the downside risk it captures the spirit. Like sharpe ratio, sortino ratio doesn’t guarantees future returns.

Conclusion

Sortino ratio is one method of calculating risk adjusted returns. Best suits for the investors comparing portfolio’s based on the downside volatility. Practically one can’t ignore the upside volatility completely. The returns from the upside volatility is achieved by taking additional risks. So risk is a two way, when the risk leads to upside outperformance on the other side it may lead to downside underperformance also.

Hi,

Nice explanation about the sortino ratio. Could you please provide me the custom backtester code to calculate Sortino ratio in Amibroker.

Thanks

🙂