As of 1st OCT 2009 Nifty P/E Ratio reads 22.90. Fundamentally 22.90 sounds that nifty is overpriced in terms of

fundamental value. As the market sounds bullish many of them might be in longs or more possibly willing to take a fresh long. Many of us might have a trouble with fixing the Stop Loss.

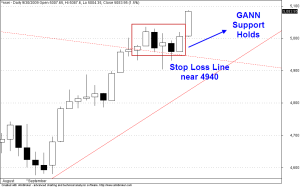

GANN line plays an important role in fixing a stop loss As a regular reader of this blog you could know that GANN FAN lines act as

a support/resistance point . And Support/Resistance line decreases/increases with respect to time..From the above picture Chart 1 shows that GANN Fan lines are applied to Nifty 2 year chart from the chart we had earlier concluded that 4980-4990 could act as resistance zone But the resistance zone was broken on 18th Sep 2009. Chart 2 shows the zoomed part of the recent scenario.

From the chart 2 we could observed that Since 18th Sep 2008 the GANN Support lines hold without any small glitch for the past 6 days followed by a clear trend reversal yesterday(30th SEP 2009). From the Zoomed GANN Chart we could easily identify that 4940-4960 will act as the Base Support in Coming sessions which could be the stop loss and exit point for your long. Below 4940-4960 levels hungry bears are waiting!!!

where is the resistance.. the chart seem to suggest above 6000?

nifty has takens support exactly at the gann support. kudos to you.