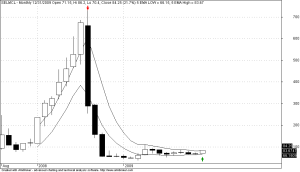

SELMCL Montly Charts

SELMCL is oscillating between the 5 EMA(High-Low) Montly bands since April 2009

and gave a buy signal(as shown in green arrow on the montly chart) on last Dec 31,2009 with huge spike in volume and also trading

above the 5 EMA(High) Montly for the ver first time . Earlier attepmt to close above

5 EMA(high) had made during Jan 2008 season.

There interesting fact is that currently this stock is trading above 13 EMA>34EMA>55 EMA

as per daily time frame i.e Rs74.24>Rs72.89>Rs72.26 and also above 200 day Moving average 71.05. All the above factors symbols the bull pattern formation in this stocks

and suits for 3-4 month investing purpose for 25-30% gains from this stock

And as per weekly time frame supports are available at Rs 73.34(13 EMA-Weekly) and 76.93(34 EMA-Weekly).

Investors can try to invest in dips in this counter with a tight stop loss of Rs73