Nifty CMP : 4715

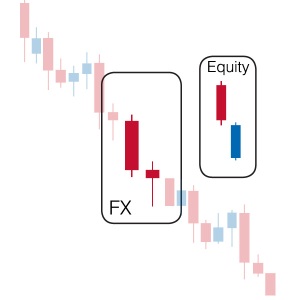

Candle Stick Pattern : ON-NECK Bearish Continuation Patterns

Direction : Bearish

Type : Continuation

Reliability : Moderate

Its clearly visible that we are still in a bearish phase as the nifty followed a bearish ON- Neck & Thrusting Continuation Patterns. As seen in the Nifty Charts we closed at 4740 on 02nd JUNE with a long black candle. And the Very Next day (03rd June) as expected we opened at 4739 well below the body of yesterdays Long Black Candle and then fell to a low of 4634 followed by the recovery upto 4715. But this recovery is not strong enough to beat the bears. Finally we formed the formation ON-Neck Bearishness Continuation Pattern in Nifty charts

Click the charts to get enlarged

How to Identifty ON-NECK & Thrusting Continuation Patterns

1)A long black candle forms in a downtrend.

2)The next day gaps down from the previous day’s close; howver, the body is usally smaller than one seen in the meeting line pattern.

3)The second day closes at the low of the previous day.

Click the charts to get enlarged

Pattern Psychology

After a market has been moving in a downward direction, a long black candle enhances the downtrend. The next day opens lower, a small gap down, but the trend is halted by a move back up to the previous day’s low. The buyers in this upmove should be uncomfortable that threre was not more strength in the upm,ove. The sellers step back in the next day to continue the downtrend.

So Whats up are we gonna end in red… Already almost all the technical indicator

are in deep bearish phase and also said by Genius Jaggu TRIN indicator for 4 june is 0.85(which is bearish one). Its too early to say that we will end in red by tommorow. Better be a market watcher and see the Bearish Fireworks in Dalal Street

Regards,

Rajandran R