Nifty fell on late wednesday and banking stocks led the decline.The Bank Nifty fell 1.9% as yields on bonds rose, heightening concerns over the lenders’ debt holdings. Banking stocks such as ICICI Bank, State Bank of India (SBI), Punjab National Bank, Bank of India, Axis Bank and Canara Bank are down 2% each. IDBI is the top looser and lost more that 6%. It should be noted that Reserve bank of India on Tuesday cuts banks’ statutory liquidity ratio by 50 bps to 22.00 pct of deposits from August 9 and leaves repo rate unchanged at 8 percent

[wp_ad_camp_5]

Nifty and Bank Nifty hourly charts currently in positional sell mode. And bank nifty very recently turned to positional sell mode on the later half of the wednesday trading session. Currently the resistance zone comes very close to 7792 and 15585.7 respectively. Reverse your position to positional buy mode if the support zone breaks on hourly basis.

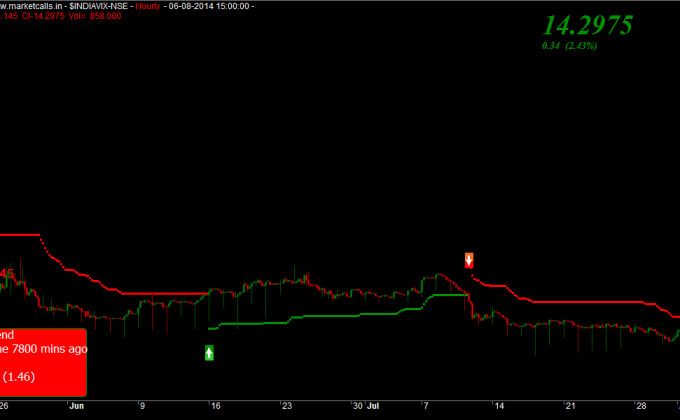

India VIX Hourly Charts

India VIX still maintains the positional sell mode since mid of july 2014 and currently the resistance zone comes under 15.73. Any breakout would like to show increased volatility in the market. Currently no much significant movement in India VIX.

Nifty Open Interest Lookup

Currently both 7300PE and 8000CE holds equal amount of open interest indicates market for current expiry close is likely to be little broad ranged. And option writers are expecting nifty to show volatility and it could trade in the range of 7300-8000 range. Lot of Volatility expectation from option writers for current month expiry.